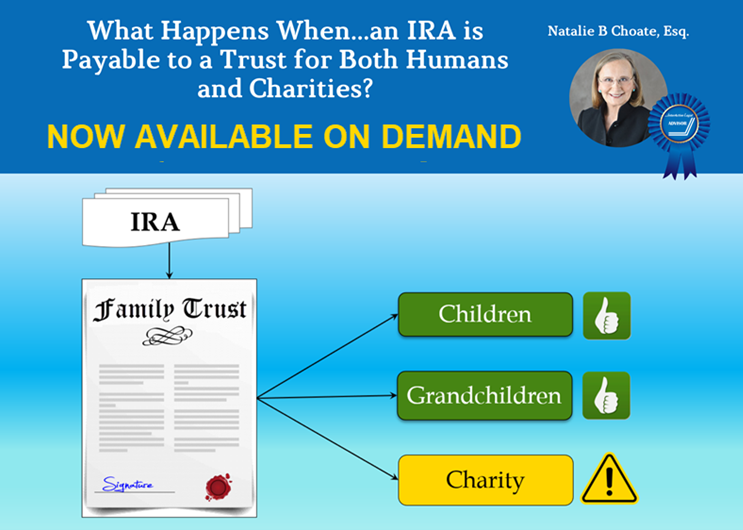

What Happens When…an IRA is Payable to a Trust for Both Humans and Charities

Drafting trusts that will receive retirement benefits has been a challenge for estate planners, even before SECURE. And as we navigate the post-SECURE landscape, new drafting issues continue to arise. Some of those issues are helped along with new legislation – such as “SECURE 2.0” – or may have been addressed in proposed regulations (that are not yet final). One common issue is how to include charities in the estate plan when planning for retirement benefits.