Exclusive On-Demand Webinar from Natalie Choate

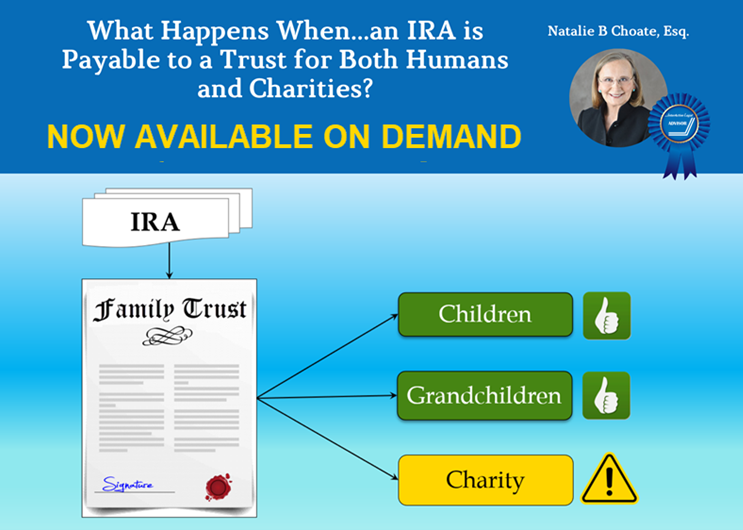

Drafting trusts that will receive retirement benefits has been a challenge for estate planners, even before SECURE. And as we navigate the post-SECURE landscape, new drafting issues continue to arise. Some of those issues are helped along with new legislation – such as “SECURE 2.0” – or may have been addressed in proposed regulations (that are not yet final). One common issue is how to include charities in the estate plan when planning for retirement benefits.

$120 for subscribers to RetirementBenefitsPlanning.us* Subscribers

Login NOW for 20% off coupon code

*$150 for non-subscribers.

NOTE: If you are an InterActive Legal subscriber you can access this recording FREE on the InterActive Legal subscriber website.